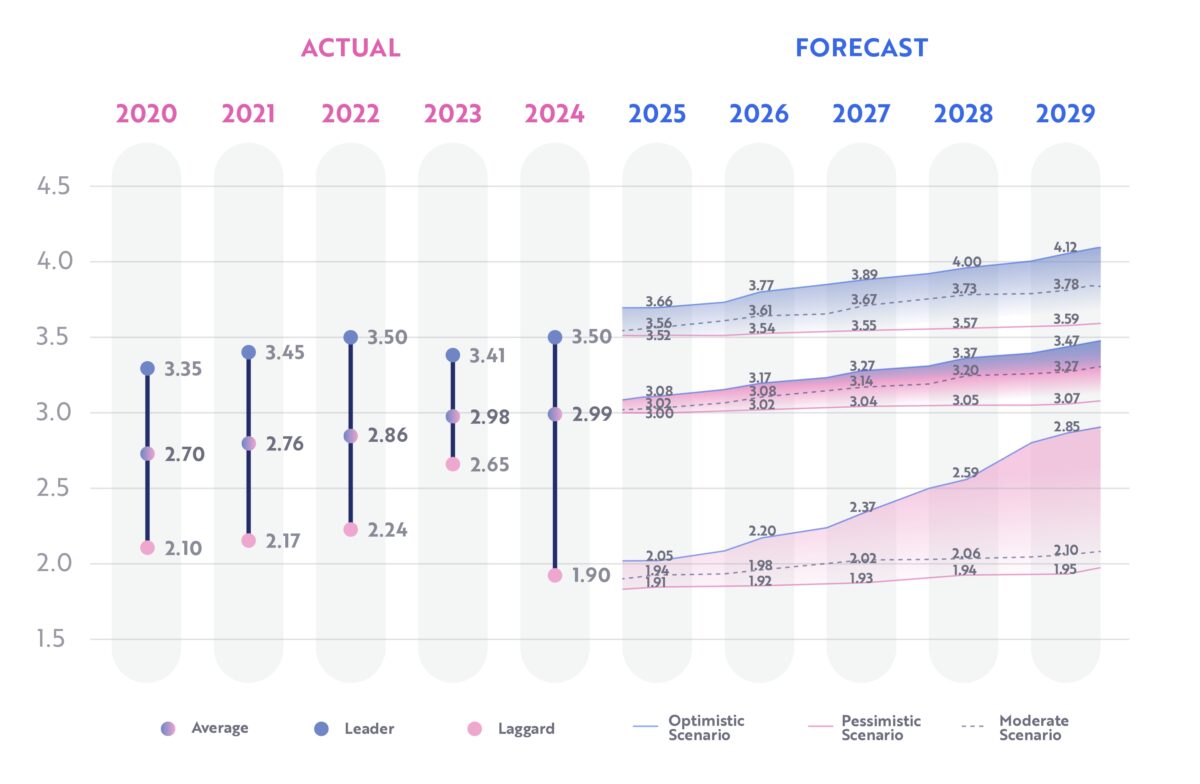

Figure 1: Insurance Industry DMI Evolution (2020–2029) with Scenario-Based Forecasts

Leader, Average, and Laggard Trajectories under Optimistic, Moderate, and Pessimistic Projections

Insurance Digital Maturity Forecast to 2030

Digitopia’s five-year forecast reveals diverging futures:

Leaders: steady strength at 3.50 in 2024. On an optimistic path they reach 4.12 by 2029, setting the pace for the market. Moderate 3.78. Pessimistic 3.59.

Average Insurers: from 2.99 in 2024 to 3.47 by 2029 in the optimistic case. Moderate 3.27. Pessimistic 3.07.

Laggards: at 1.90 in 2024. With decisive action they can climb to 2.85 by 2029. Without it they stall near 1.95.

The divide widens by 2030. Leaders convert AI and customer centricity into dominance. Average firms must accelerate. Laggards face existential risk unless they reinvent now.

Insurance Digital Revolution Has Arrived

Three Strategic Imperatives for 2030-Ready Insurance

How to Get There: Requirement 1

Digital, Customer-First

- Personalize interactions across the lifecycle

- Remove friction from onboarding, policy, and claims

- Shift from reactive claims to proactive risk management

Outcome: higher loyalty and profitable growth.

Digital Solutions →

How to Get There: Requirement 2

AI-First Operations

- Automate underwriting, claims, and policy admin

- Use predictive analytics for risk, pricing, and fraud

- Deploy intelligent assistants for 24/7 service

Outcome: faster decisions, lower cost, better experiences.

Artificial Intelligence →

How to Get There: Requirement 3

Upskill Your People

- Build data, AI, and digital skills at scale

- Create a culture of experimentation and improvement

- Empower internal change champions

Outcome: a workforce that can execute the roadmap.

Digital Upskilling →

Five Predictions for the 2030 Insurance Industry

- Parametric insurance goes mainstream with instant, event-triggered payouts supported by IoT, satellite data, and blockchain.

- Cyber insurance surges into a core growth line as AI-enabled risk and protection become standard.

- Insurance becomes fully data-driven with real-time health, telematics, and wearables transforming pricing and claims.

- Digital self-service is the default across policy, service, and claims with humans focusing on complex cases.

- Open insurance ecosystems embed coverage into retail, auto, health, and finance journeys to unlock new revenue.

How Does Your Digital Maturity Compare to Industry Leaders? Benchmark Your Digital Maturity

The 2024 Insurance Digital Maturity Report reveals where companies stand today, and where they need to go. Compare your performance with leaders, average performers, and laggards.

Are you leading the shift or reacting to it? Use our data to compare your performance, assess your risks, and find the fastest route to transformation.

Start Building Your 2030 Advantage

Get the full Future 2030 Insurance Outlook with maturity forecasts, strategic priorities, and practical next steps to move faster with confidence.