COVID-19 has been relentless in battering the status quo established in the retail sector. Foundations long considered to be immovable were swept away in mere months as 90% of retail space was closed for months or years, some of which never reopened. Evolution is typically a slow process, but as is often the case, crisis has expedited the process and forced retailers to completely reassess their business models to achieve a sustainable future.

It should come as a surprise to no one then, that these models are digital.

A Whole New Hyper-Accelerated World

And so, as we emerge from what is hoped to be the worst of the COVID-19 crisis, we look to the future and the trends that are expected to influence the consumer retail market in the decades to come. As expected, online retail has grown significantly year on year since 2020, markedly increasing previous relatively minor incremental gains to achieve two to three times the annual growth that took place in the prior five years.

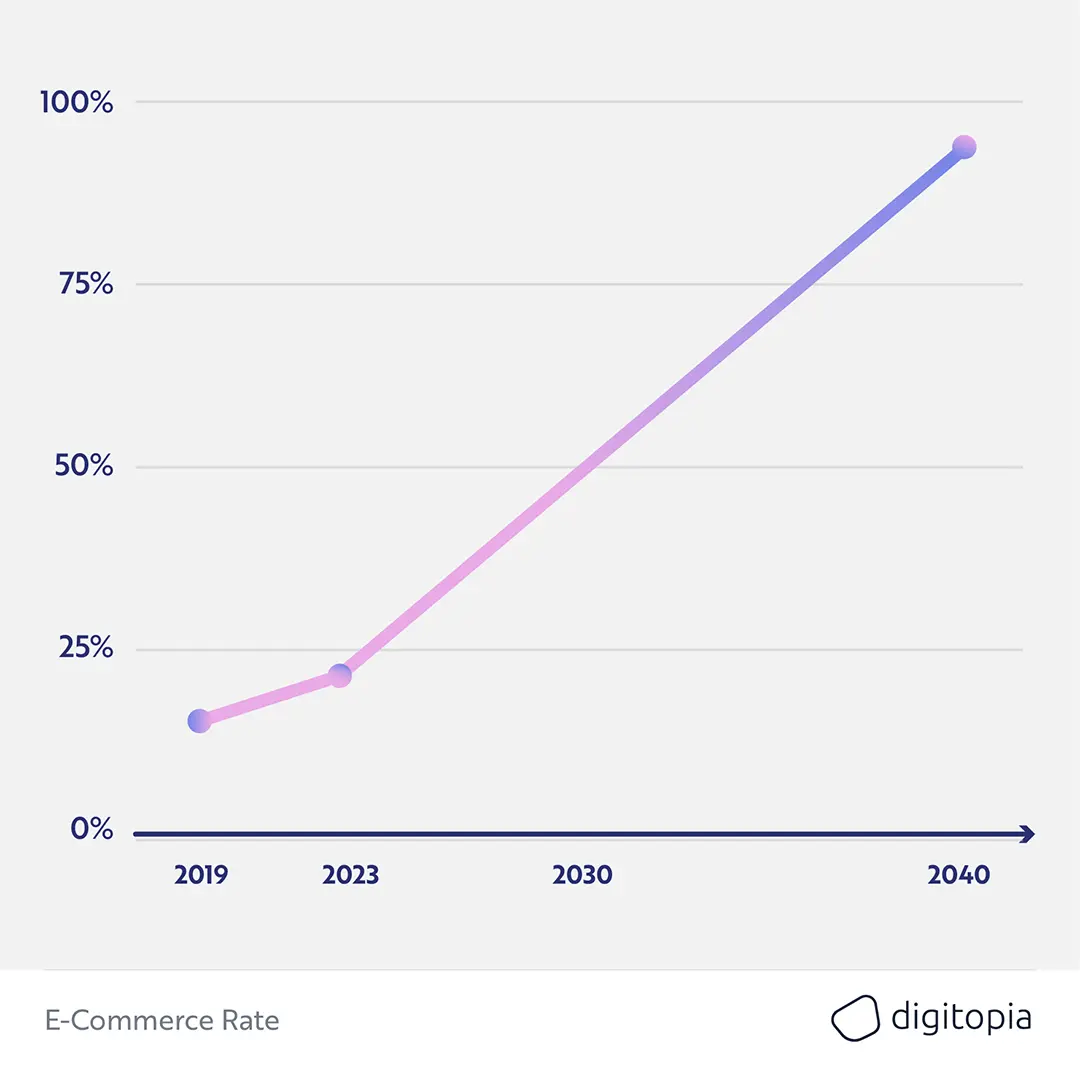

Experts do not expect this growth to change in the coming years, rather that it is a precursor of things to come. Ecommerce is expected to reach 22% of all retail sales by 2023, with some estimates anticipating that online sales could constitute 95% of all retail transactions by 2040.

This might seem like an ambitious target, but the prevalence of new platforms online is making it possible for even small businesses to achieve a cost-effective online method of communication with customers, largely eliminating the need for a lot of bulky physical assets.

Could the era of the physical store soon be over?

Reshaping the Retail Store

While exciting for digital retailers, things are looking less positive for physical stores. In the UK today it is expected that retailers are currently 20% overcapacity on their retail space requirements, with no commercial justification for the additional square footage. With the onset of COVID-19 this number will have increased significantly as companies move more of their business online.

A range of proposals have surfaced for what the high street of the future could look like, with stores becoming redundant as a means of selling goods they could potentially be repurposed into social venues aimed at attracting consumers to interact with brands in new ways. Some retailers have flirted with the idea of using their excess space for live music and other entertainment mediums that can help consumers feel the value of visiting their stores and keeping their brand at the front of their minds.

Ultimately however it is unlikely that, as retail moves increasingly online, retail brands will every experience the return on investment in their stores that they have previously and must consider how to remain competitive in the new digital age.

Going Digital – Strategies for Companies Large and Small

With the ever-pressing need to become more digital, brands of all sizes must find ways to compete on an international scale. Smaller brands might struggle to establish their own online shopfront due to initial upfront costs, but they do have options that allow them to compete. Some larger organisations such as Next are developing online platforms that will enable shops to leverage the well-known brand to sell their own goods. Meanwhile, larger brands are frequently acquiring smaller organisations with advanced online stores to benefit from the synergies with their own products to create a more exciting, dynamic online marketplace.

Maintaining Major Margins

One challenge organisations will face in the digital age is a potential decrease in margins, as additional costs associated with delivery, return and customer service can eat into profits. These costs are unavoidable with today’s technology, and as such it is critical that companies do what they can to mitigate them as they move digital.

Optimisation

Retailers must do everything they can to optimise their logistics in the digital age. Shifting trends can have major implications on their end-to-end supply, and certain aspects of the deliver process can disproportionately affect cost. Working with partners to reduce final mile costs is a major game-changer for a lot of online distributors, while optimising the reverse logistics of returns will enable suppliers to limit its impact on margins.

New Technology

As the retail sector continues to digitalise, new technologies will inevitably emerge to support efficiencies, and it is critical that retailers take advantage of these tools to avoid disruption from competitors. Existing technologies are already proving new ways to reduce waste through more effective packaging and carbon footprints.

Act Now

Retail is changing, and likely will never be the same. The hyper-acceleration of digital retail has merely sped up an inevitable process, and it is important that all retailers (not just large brands) have a plan to transition and take advantage of digital channels to protect their profit margins.

To date, many retailers are anticipating a return to pre-COVID consumer behaviour, unaware of the true threat waiting to disrupt their business in the next two decades. Companies must act today to be ready and reap the benefits of a truly international market of consumers at their fingertips.

But what can be done?

Act today. Seek to understand the current digitalisation of your retail organisation through effective measurement, and then construct a roadmap to carry you through to a new, brighter digital future.