Crypto is like teenage sex. Everybody talks about crypto. But nobody really knows what it is and how it works. Very few people have real experiences. Everybody else lives on their fantasies. For this reason, there is a huge demand for clarification. This article is supposed to help you to understand this trend because it’s here to stay.

It all started with Satoshi Nakamoto. We don’t know who he really is or if he truly exists. But this is the name behind Bitcoin and the underlying blockchain technology. In October 2008, he published his famous white paper, his vision to democratise payments and, eventually money.

Bitcoin was, for a very long time, a thing for geeks and nerds. Very few people understood how to get access, use it, mine it, and be part of it. But the value was below 1 Dollar for a very long time. The news with the underground website Silk-Road made Bitcoin’s image even worse, it looked like it becomes the illegal payment method of drug dealers, human traffickers, gun resellers, and other criminals.

The underlying technology, which is blockchain, became popular parallel to the rise of artificial intelligence. In the 2010’s everybody was talking about AI and blockchain to radically transform the world and solve the toughest problems the world has. AI is still super hype, but the blockchain is not as much.

Technology giants are fuelling and driving the AI hype. Even nations are now in competition. The US seems still to lead the race, but China announced mega investments, teams, and centres, to become the world leader in 2030.

Blockchain’s and Bitcoin’s biggest inhibitor to make it understandable is its complexity. Decentralized and distributed systems, super complex cryptography algorithms, and this continues connotation with the dark side, makes a lot of people very nervous about Bitcoin and all the other cryptocurrencies.

Not everybody loves Bitcoins and cryptocurrencies

One of the most famous opponents is Nouriel Roubini. He basically disregards all of the crypto-world at all and says “it’s the mother of all bubbles” meaning that the true value of them is equal to zero. Another famous supporter of this worldview is Jamie Dimon, CEO of JP Morgan Chase.

But things change. So do opinions. The tech giants were neglecting the crypto-world for quite a while. But in 2017 first one person, later in 2018, a team at Facebook started to work on something called Libra, which became Diem in December 2020.

If money transfer, payments, savings, subscriptions, and many more financial transactions, become as easy as mails or short messages, it will change a lot. Banking has certain rules and barriers. Still, there are many unbanked people. But these people are already on social media and have a smartphone. It would be a great service to these people.

But this development bares a lot of risks as well. Financial information lands in the hands of tech giants, famous for turning customer data into advertisement-gold. It also bares the risks of being hacked, stolen, published, or abused. These risks are also valid for banks.

Despite all odds and crashes, the crypto market is growing exponential

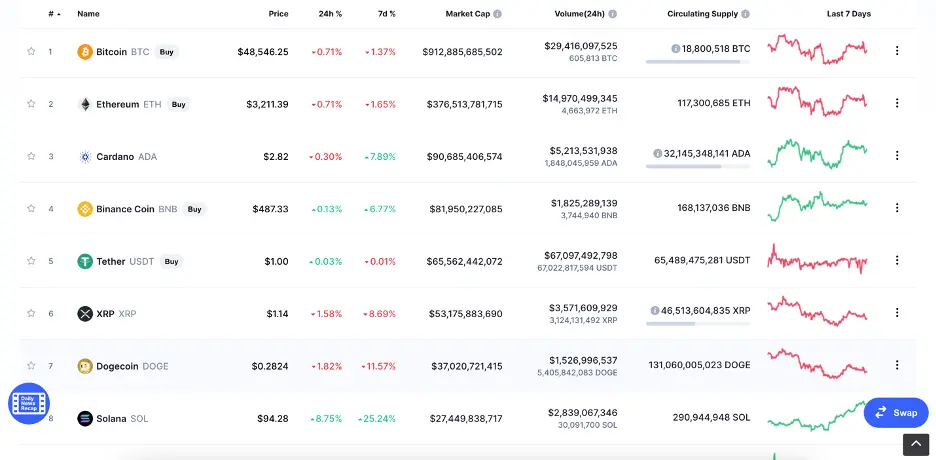

Bitcoin is not the only cryptocurrency. As of August 2021, Coin Market Cap enlists 6207 different cryptocurrencies. Many of them are inactive or obsolete. As for Nouriel Roubini, there real value is “zero” anyways.

Source: https://coinmarketcap.com/

But everybody must understand that this trend is real. Cryptocurrencies are here to stay. There are people and companies investing in them, trading them, mining them, and transferring them back and forth. Do they fulfill a certain goal? Maybe not. But do the multiple (and difficult to understand) financial derivatives fulfill any more noble goal? I don’t think so. Therefore, let’s view these cryptocurrencies as another form of financial product.

The outrage of bankers, central bankers, financial regulators is easily understandable. Because the crypto world is outside their regulative boundaries. It’s unchartered territory. So, they see it as a threat. For sure it is. But the US FED, the SEC, and many other regulators have already worked on the matter for many years.

Christian Catalini of MIT Cyrptoeconomics Lab has a great summary in an HBR article. There are three ways to move forward. One is stable coins. Two is deposit coins. And three are central bank digital currencies. The biggest change, progress, and disruption could come from this third option.

Investments in cryptocurrencies keep on booming. We see periodically new unicorns in the crypto world. Crunchbase just reported four new unicorns this year, and it’s just August. This shows a clear trend towards a bullish market for cryptocurrencies for the upcoming period. How long will it hold? I don’t know…

Future Scenarios for Bitcoin

Mining gets harder and harder. As of August 15th, there are 18.79 million Bitcoins in circulation. The maximum number of Bitcoins is limited to 21 million. That endpoint will not be reached any time soon. But let’s assume we’re there. What happens then?

Scenario 1: Bitcoin loses its attraction

Once it reached its peak, in terms of circulation and value, it may lose its vibrancy and the attention of media. If it would go thru a hype cycle like the Gartner one, there will be a new super-topic, yet another super mysterious hero, the next Satoshi, with an even better idea. Then all investments will go in that direction…

Scenario 2: Bitcoin just stays stable

Bitcoin is just another investment category. The market may be washed with alternatives. Industry-specific cryptocurrencies, company-related digital means of money and payments, countries continue to issue their own digital currencies backed and leveled to their real national currencies and many more options. Which one would you buy or trade or use as means to store value? Nobody really knows. But in this scenario, Bitcoin would just continue its humble existence, and the value would settle according to market demand.

Scenario 3: Bitcoin hype goes wild

Scarcity and rarity cause exponential value increase. The sky is the limit. Where can it end? Nobody knows. There was this famous tulip mania in the Netherlands in the 17th century. Usually, these kinds of baseless inflationary hypes result in disasters. We’ll see what will happen to Bitcoin…

Future Scenarios for Digital Currencies

CBDC means central bank digital currencies. This is a very interesting topic. Many countries’ central banks are working on this. US FED, China’s PBOC, the Bank of England, and the European Central Bank.

Besides Facebook’s Diem project, also banks like JP Morgan Chase are working on their own version of a digital currency. Jamie Dimon was a long time and heavy opponent of anything crypto. But the bank realised that this trend is here to stay and it continuously grows. Compared to their assets under management (AUM) and US Dollar daily money transfers, Bitcoin and crypto is still very small. But if you understand exponentiality, then you know that digital growth will outperform conventional markets. Digital currencies could become huge very soon.

Our advice would be not just to follow the popular news, investments, and fancy start-ups, but more so the total market volume, regulations, big companies’, and big nations’ moves on the subject matter. It will be very interesting to watch what Facebook, JP Morgan, the US FED, and especially China will do.

Resources you should follow closely

As with all popular subjects, there is an inflation of blogs, magazines, websites, podcasts, and many other formats, basically promising heaven on earth, claiming to be the best resource of all, and of course, having all the answers to all your questions. How possible is that?

We carefully reviewed the environment and looked at quite a number of options and filtered them down to very few. The ones below are truly valuable and very regularly updated. Depending on your current knowledge level, your interest in the topic, and your level of analysis, you need to decide for yourself how much time you want to spend with these resources.

Andreessen Horowitz is one of the leading venture capital firms in the valley. Marc Andreessen is not only famous for being the inventor of the modern web browser (originally NCSA Mosaic) but more so for his Wall Street Journal article published on August 20, 2011.

They’ve summed up quite nicely everything important about blockchain, the world of crypto, and all related topics. Read the series of articles on their blog or watch the videos to learn how they see the world changing with emerging technologies.

https://a16z.com/crypto-startup-school/

Don Tapscott is one of the leading authorities on the impact of technology on business and society. Author of many books, frequent keynote speaker, and has coined many concepts widely used in the industry.

Don Tapscott has also a strong opinion on blockchain and the future of crypto businesses. In a rather early TED talk in June 2016 he elaborates on how he sees this trend and technology unfolding and impacting almost all aspects of daily life, personal and business. Let’s have a view here…

Another very interesting source of information is the marketplace coindesk.com. not only they are following the market very closely, but they have a very deep understanding of what’s going on in the foreground and the background. Especially concerning the market volumes, ups and downs of various cryptocurrencies, and much more.

Of course, there are many more resources. You could become dizzy quite quickly by the variety and the vast amount of information overflow. Therefore, our advice, focus on very few selected and trusted sources of information and follow only what is interesting to you, your business, and your role. Anything beyond that might become counterproductive.

Conclusions: Crypto is here to stay. Understand, embrace, and benefit

Central banks have accepted. Governments have understood and some even see interesting opportunities. The Wall Street ecosystem realised what’s going on and tried to position. The start-ups of the world see tremendous opportunities. Venture capital is flowing hugely in this direction. So, this is evidence that this is not a fad. Blockchain and cryptocurrencies are here to stay and to flourish.

Now, given this fact, one should embrace these realities. Embracing starts with understanding and participating. Learn what’s going on. Understand the impact on your business and your stakeholders. Try to influence to your benefit and determine a pathway into this world.

Benefiting from blockchain and crypto is possible in multiple ways. Incorporating these technologies into existing processes and value chains is already a best practice and deployed in several industries. IBM’s Food Trust is a great example for the food producing and distributing industries and for all consumers. Medicalchain is a great example in the healthcare industry. Some start-ups rapidly became unicorns due to their success and the vast interest of investors.

There is no silver bullet when it comes to blockchain/crypto success. It is always the spirit of innovation, fail forward, and the ingenuity to discover what creates value for the relevant stakeholders. Start with asking “what needs to be improved?”. The next question should be “for whom?” and then of course “why?”. The “how?” and “what?” are the rather easier questions.

It’s not about technology. It’s about understanding the capabilities of these novelties and applying them in a genuine way that solves something in a better way, nobody had thought of before. Easier said than done. But this is the essential reality of successful and disruptive innovation. Also valid for blockchain and crypto. Good luck.