33%

of insurance companies have reached advanced digital maturity, highlighting a substantial opportunity for growth and competitiveness.

40%

faster claims processing and 25% cost reduction are achievable for insurers utilizing AI, leading to improved operational efficiency and customer satisfaction.

70%

of insurance customers demand digital, omnichannel experiences, emphasizing the need for insurers to strengthen their digital capabilities.

Transformation Strategy Driving Measurable Outcomes

We offer bespoke solutions designed to overcome the unique hurdles of the insurance sector. Through our strategic framework, we enable insurers to flourish by driving customer experience enhancements, operational efficiencies, and product innovation, powered by digitalization, AI integration, and advanced analytics.

JOIN THOUSANDS OF PIONEERS...

How We Help Insurance Companies

Customer-Centric Digital Strategy

Collaborate to design strategic digital roadmaps that enhance customer experiences through personalization, omnichannel engagement, and data-driven insights.

AI-Driven Risk Assessment and Fraud Detection

Guide insurers in selecting and implementing AI solutions for predictive risk assessment, intelligent underwriting, and fraud detection to optimize operational efficiency and accuracy.

Digital Capability Development for Workforce

Provide strategic guidance on upskilling insurance teams to effectively use digital tools, data analytics, and AI technologies, fostering a culture of agility and continuous improvement.

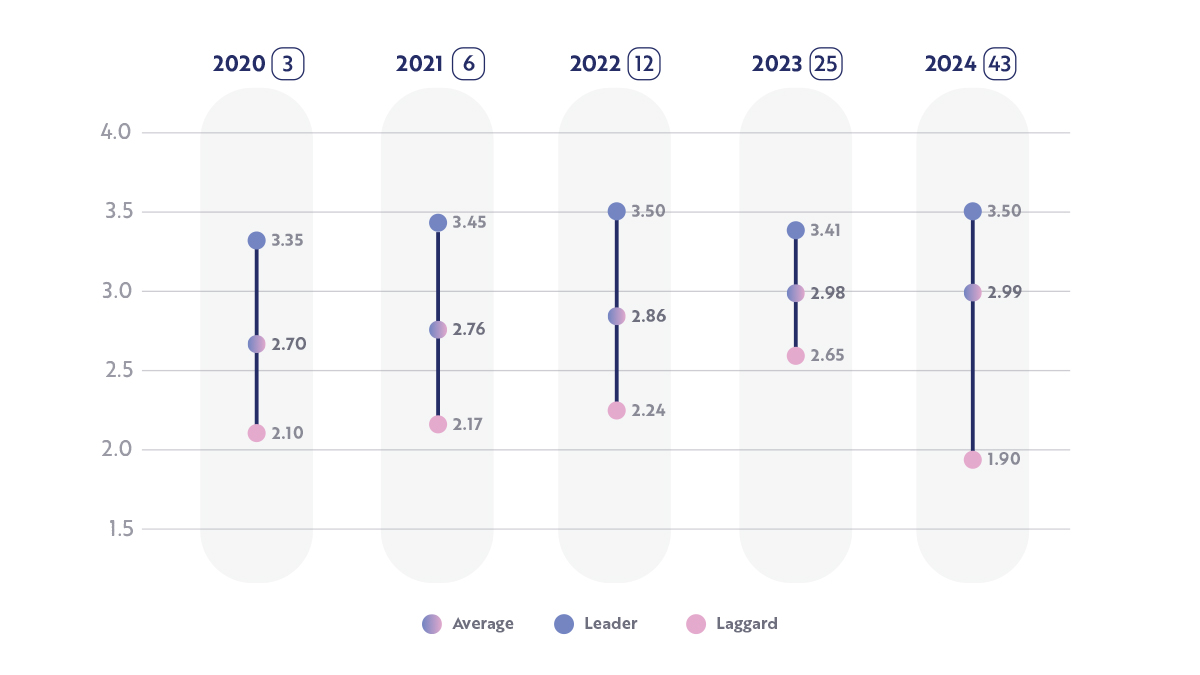

Figure 1: Digital Maturity Index (DMI) Study Results:

Insurance Industry Score, Averages, Leaders, and Laggards

Digital Maturity Index of Insurance Industry

While digital transformation is reshaping insurance, progress is slowing, and disparities are growing. This year’s benchmark highlights:

- Slow digital progress – The industry’s average maturity score is increased, but growth has nearly stalled.

- The gap is widening – Leaders now score 3.50, while laggards have fallen to 1.90, exposing a growing divide in digital capabilities.

- Three key differentiators – Leaders excel in velocity, cultural transformation, and AI-driven analytics, setting them apart in a competitive market.

The findings are clear: insurers that prioritize AI, agility, and digital-first customer experiences will shape the future of the industry.

Key Technologies Transforming

the Industry

The insurance industry is undergoing a profound transformation driven by digital innovation. With rising demand for personalized and efficient services, insurers are leveraging technologies like AI, IoT, and blockchain to stay ahead. Explore how these advancements are transforming the industry and leaders drive business growth.

Frequently Asked Questions

Transformation in insurance involves integrating digital technologies, AI strategies, and data-driven decision-making into operations, customer experiences, and product development to enhance efficiency, accuracy, and engagement.

It enables insurers to remain competitive, optimize operations, reduce costs, improve risk management, and deliver personalized customer experiences in a dynamic and customer-driven market.

- Enhance Customer Experience and Engagement: Utilize advanced digital platforms and AI-driven analytics to deliver personalized, seamless, and omnichannel customer experiences that enhance satisfaction and loyalty.

- Optimize Operational Efficiency and Cost Reduction: Implement intelligent automation, predictive analytics, and AI-driven fraud detection to streamline claims processing, underwriting, and risk management.

- Drive Innovation and Product Development: Leverage data analytics and AI to develop innovative insurance products and services that address emerging customer needs and market trends.

Common challenges include outdated legacy systems, data integration complexities, and the digital skills gap within the workforce.

AI enhances risk assessment, fraud detection, claims processing, underwriting accuracy, customer segmentation, and personalized engagement, leading to improved operational efficiency and customer satisfaction.

By delivering seamless omnichannel experiences, personalized interactions, and data-driven insights, enhancing customer satisfaction, loyalty, and retention.

It empowers employees to effectively leverage digital tools and AI technologies, enhancing productivity, operational agility, and customer-centricity.

Through predictive analytics, AI-driven risk assessment, and intelligent fraud detection algorithms that enhance accuracy and operational efficiency.

Conduct a digital maturity assessment, define strategic objectives, and develop a digital transformation roadmap aligned with customer expectations and business goals.

Transform Your Insurance Operations Today

Contact us to learn how to lead the insurance industry with strategic digital transformation, AI integration, customer engagement, and digital capability development.