DIGITAL MATURITY REPORT 2024 / INDUSTRY FOCUS

Digital Maturity in Banking

The banking industry is at a pivotal moment. AI, automation, and advanced analytics are reshaping financial services, yet many banks struggle with legacy systems, regulatory constraints, and cultural resistance to change.

Leaders are embracing AI, seamless digital experiences, and data-driven decision-making to stay ahead. Meanwhile, the gap between innovators and laggards is widening.

This report uncovers the state of digital maturity in banking, the strategies of industry leaders, and key insights to accelerate transformation.

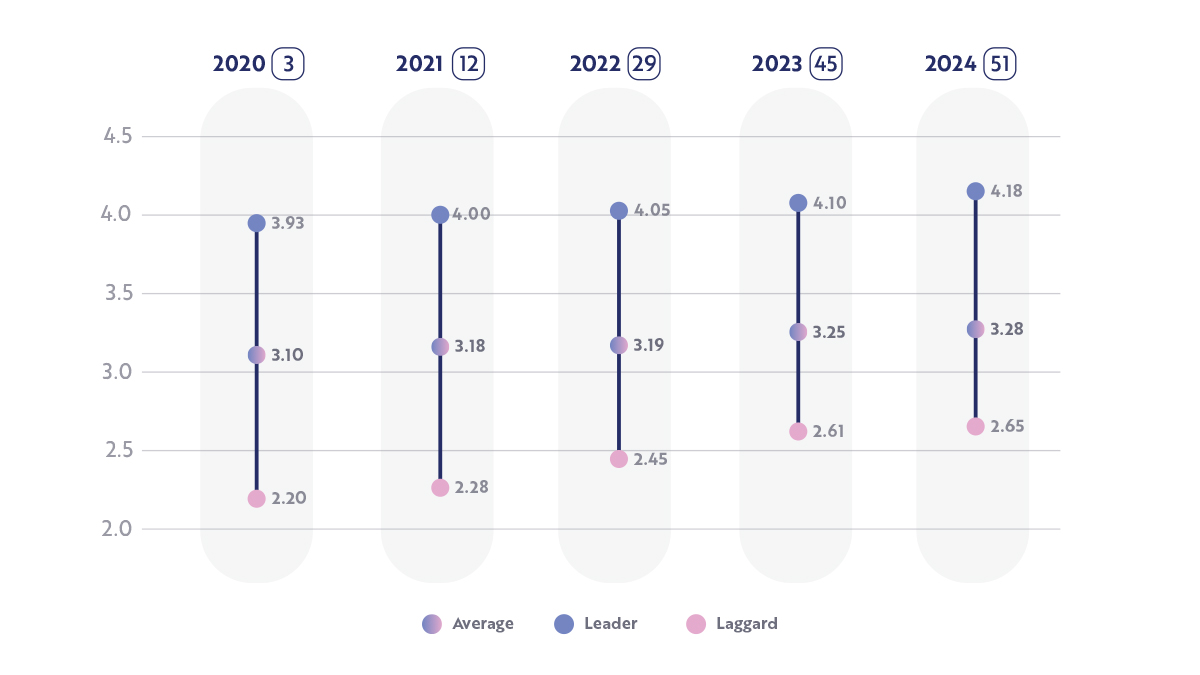

Figure 1: Digital Maturity Index (DMI) Study Results:

Banking Industry Score, Averages, Leaders, and Laggards

Digital Maturity Index of Banking Industry

Banking leads in digital transformation, but progress is slowing, and the gap between leaders and laggards is widening.

- Slower growth – The industry’s maturity score rose from 3.10 (2020) to 3.28 (2024), but regulatory challenges and slow decisions are stalling momentum.

- Widening gap – Leaders score 4.18, while laggards remain at 2.65, falling further behind.

- Key success factors – Customer obsession, financial discipline, and AI-driven technology define top performers.

Banks that prioritize AI, agility, and customer experience will lead the future of finance.

A Comprehensive Analysis of Digital Maturity in Banking Industry

Banking is changing fast. Will you lead the transformation or struggle to keep up?

Download the Digital Maturity Report 2024: Banking Focus now and gain the insights needed to drive innovation, enhance customer engagement, and future-proof your organization.

Digital Maturity Report: A Comprehensive Analysis Across Industries and Countries

Discover the pulse of digital transformation with our 2024 Digital Maturity Report, leveraging 621 unique measurements across more than 10 industries and 20 countries to reveal critical trends and opportunities. Elevate your strategic vision—download the report for actionable insights.