Flux is your friend.

You know the Titanic, right? Even if they had seen the iceberg early enough, manoeuvring around it would have been next to impossible. Not so with a power boat. The moment you touch the steering wheel or the throttle, you get an immediate response. This is what you need during times like these.

Everything is shaking up, everything is moving, change is at its maximum possible levels. Uncertainty is higher than ever before. We are experiencing an unprecedented time, including war, pandemic, financial crisis, recession, stagflation, mass immigration, climate change, and digital disruption to top it all off.

A very smart guy wrote a book back in 1999 called “Only the Paranoid survive”. That smart guy is obviously Andrew Grove, then CEO of Intel, the global chipmaker. With a clear mind, and with a long-term rigid strategy, you can’t survive the pace of our times. Since the utterance of Moore’s Law, the world is not the same as before.

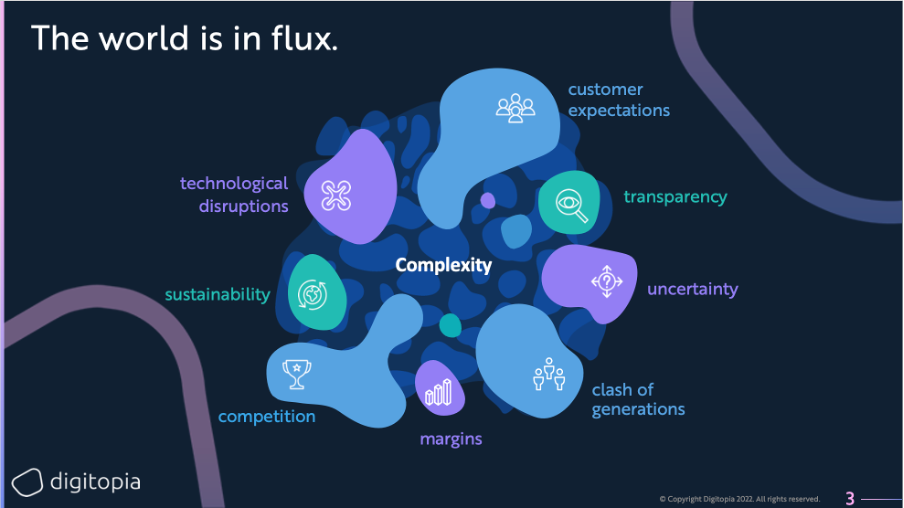

We put the things which we observe in one picture and tried to illustrate how we feel about it. For me, the keyword is “complexity”. It is exponentially increasing, unpredictable and always changing shape, continuously surprising and confusing your assumptions, making it super-complex to steer your ship.

We are all on a journey.

Since the Stone Age, mankind has been on a journey of curiosity, discovery, and progress. We’ve come quite far. Especially during the last 250+ years, with the Industrial Revolution, we dramatically changed the way we live, for the better. On top of that, after the Second World War, for the last 60+ years we have seen globalisation spreading, the digital revolution is changing everything again, and makes everything even better. There are almost 8 billion people on the planet. Most of them have a decent standard of living, connected to electricity, water, internet, education and healthcare services that are better than ever. There is still a lot to do, especially for the lower end of this so-called pyramid.

For us professionals, executives, businesspeople, and entrepreneurs, the world today is full of challenges and opportunities. The world is in flux, as we said above. So, imagine that we are all sitting in various ships or boats on a rough and rolling river. This is the flux, this is about competition, this is about survival.

Those who are the nimblest, those who can anticipate the next wave, position accordingly and ride it will definitely experience an advantage. Sometimes you think that particular wave will last forever, which it never does, then usually you run into inertia, like the Kodaks and Nokias of the world.

Coming precisely to our times, it is not just the digital revolution. That we have addressed with our digital maturity index service, which we definitely recommend as a kind of navigation system, a health check of your organisation.

These days we must add a very important subject to the executive agenda. Which is the sustainability agenda, of course. Climate change is not a hoax. Climate change will not go away. Climate change is already hurting businesses and people and the planet. If we don’t take action, we will dig our own grave and become history. Nobody wants this to happen.

So, doing good to the planet and the climate is and could and must become good for your business. We have written many times about this before, and we truly believe it. This must become our mindset moving forward, otherwise there will be no moving forward. That’s the reason why we are so excited about our sustainability maturity index, your health check and your navigation system to steer your way and conquer your prosperous tomorrow.

And of course, at the same time, we must deliver business performance. Economic growth depends largely on the private sector and its creativity. Governments and regulators are not so good in terms of innovation. So don’t expect miracles from bureaucrats. The shakers and makers of the world have always and will always change the way we are living, working, and playing.

We call this the “business impact vortex”. If you are on top of it, as much as possible, it will be a positive swirl, which will elevate you and your ecosystem, and we will all prosper. If you are not on top of it, if you are reactive to the changes happening around you, this vortex will become a vicious circle dragging you and your ecosystem downwards, basically towards extinction. You don’t want this to happen.

What is the solution? You must be on top of this flux. You must spend some time understanding, analysing, and making sense of what’s happening around you, what you can leverage to your advantage. Our maturity services help you with this and support you to build your roadmap moving forward.

The Portfolio Approach

Investment bankers have strong nerves. They don’t get distracted by ups and downs easily, because they live with it day in day out. So, what do they do? First, they stay calm. Secondly, they are prepared for various scenarios. Thirdly, they usually split their risks in different buckets. They call it the portfolio approach. The wisdom is to know which investment to put into which bucket, and more importantly, how much of it, when and why.

Now, how can you apply this in manufacturing or retail or insurance? You already do to some extent with various bets going on in the business. You should also apply this to your transformation roadmap. You can’t change everything at once, it will take time. But you may have some outlier bets, some interesting projects, which may unleash unexpected benefits, faster than you anticipated.

The consulting firm I worked for before calls these categories “run the business”, “grow the business” and “transform the business”. You must have a portfolio of meaningful activities for each of these categories. Both digital and sustainability transformations need change and projects in all three of these categories.

Don’t be afraid of the flux. Ride the wave. Enjoy the change. Embrace the complexity. If you look at it positively, it will reveal all its opportunities to you. Look at the Fortune 500 list. Never before in history has the mix in that Fortune 500 list changed so fast. Be aware of this. Only the paranoid will survive. Our clients are among the winners. Join them.