30%

of banking institutions have fully integrated digital strategies, highlighting a significant growth opportunity.

35%

cost savings and a 40% productivity increase are achievable for banks leveraging AI.

80%

of banking customers demand seamless digital experiences.

Transform Strategically to Secure Future Outcomes

Partnering with banking institutions, we deliver tailored solutions designed to overcome their unique challenges. Our strategic approach, powered by digitalization, AI, and advanced analytics, enhances operational efficiency, strengthens customer engagement, and stimulates innovation, leading to their continued success.

JOIN THOUSANDS OF PIONEERS...

How We Help Banking Companies

Customer-Centric Digital Strategy and Experience Optimization

Collaborate to design strategic digital roadmaps that enhance customer experiences through personalized financial solutions, seamless omnichannel interactions, and data-driven engagement strategies. Guide banks in leveraging advanced analytics, automation, and AI for risk management, fraud detection, compliance, and operational efficiency.

AI-Driven Financial Insights and Personalization

Enable banks to select and implement AI solutions for customer insights, risk assessment, fraud detection, and personalized financial solutions.

Workforce Digital Capability Development

Provide strategic guidance on upskilling banking teams to effectively use digital tools, data analytics, and AI technologies, fostering a culture of agility and continuous improvement.

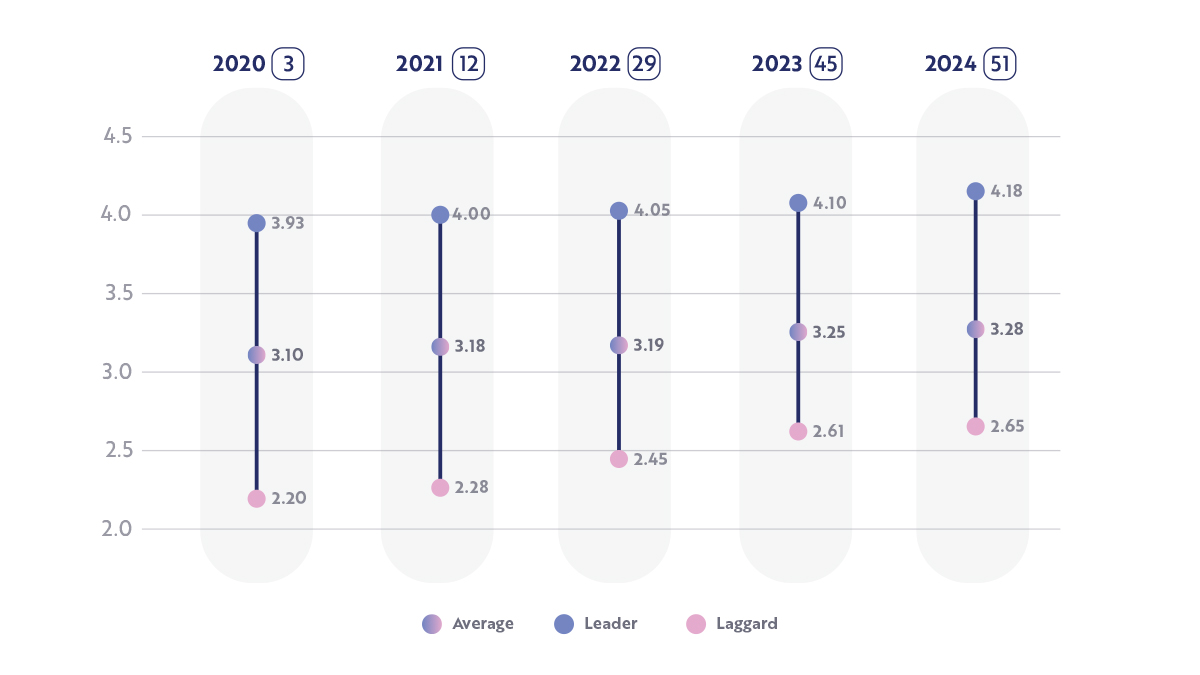

Figure 1: Digital Maturity Index (DMI) Study Results:

Banking Industry Score, Averages, Leaders, and Laggards

Digital Maturity Index of Banking Industry

Banking leads in digital transformation, but progress is slowing, and the gap between leaders and laggards is widening.

- Slower growth – The industry’s maturity score rose from 3.10 (2020) to 3.28 (2024), but regulatory challenges and slow decisions are stalling momentum.

- Widening gap – Leaders score 4.18, while laggards remain at 2.65, falling further behind.

- Key success factors – Customer obsession, financial discipline, and AI-driven technology define top performers.

Banks that prioritize AI, agility, and customer experience will lead the future of finance.

Key Technologies Transforming

the Industry

The banking and financial services industry is experiencing a profound transformation driven by digital innovation and evolving customer expectations. As consumers demand more convenient, secure, and personalized services, financial institutions must leverage digital technologies to remain competitive and meet these demands. Explore how digital transformation is reshaping banking and financial services.

Frequently Asked Questions

Digital transformation in banking involves integrating digital technologies, AI strategies, and advanced analytics into customer experiences, operations, and financial services to enhance efficiency, innovation, and growth.

It enables banks to remain competitive, optimize operations, reduce costs, enhance customer experiences, and achieve regulatory compliance in a dynamic financial landscape.

- Elevate Customer-Centric Digital Experiences: Leverage advanced digital tools and AI-driven analytics to deliver seamless, personalized customer experiences across all touchpoints.

- Optimize Operations and Cost Efficiency: Utilize automation, predictive analytics, and real-time data integration to enhance operational agility, risk management, and cost efficiency.

- Drive Innovation and Agility: Invest in emerging technologies, strategic partnerships, and a culture of agility and experimentation to accelerate product innovation and business model transformation.

Common challenges include legacy systems, complex regulatory requirements, skills shortages, cultural resistance, and cybersecurity risks.

AI enhances risk management, fraud detection, personalized financial solutions, and customer insights, leading to improved operational efficiency, profitability, and customer engagement.

It empowers employees to effectively leverage digital tools and AI technologies, enhancing productivity, operational agility, and customer-centricity.

Through integrated digital platforms, real-time analytics, predictive risk assessment, and AI-driven fraud detection.

Conduct a digital maturity assessment, define strategic objectives, and develop a digital transformation roadmap aligned with customer expectations and regulatory requirements.

Transform Your Banking Operations Today

Contact us to learn how to lead the industry with strategic digital transformation, AI integration, and advanced analytics.