Impact Assessment: Key Technologies Transforming Insurance Excellence

- Artificial Intelligence (AI):

- Automated Underwriting: AI algorithms analyze vast amounts of data to assess risk and automate underwriting processes, improving accuracy and efficiency.

- Claims Processing: AI-driven systems streamline claims management, reducing processing times and enhancing customer satisfaction through faster payouts.

- Big Data and Analytics:

- Risk Assessment: Insurers use big data to analyze customer behavior, identify trends, and refine risk models, leading to more accurate pricing and product offerings.

- Customer Insights: Data analytics provide insurers with deeper insights into customer preferences and needs, enabling personalized marketing and product development.

- Internet of Things (IoT):

- Telematics: IoT devices in vehicles track driving behavior, allowing insurers to offer usage-based insurance and incentivize safe driving.

- Smart Home Devices: IoT sensors monitor home conditions, alerting insurers and homeowners to potential risks and reducing claims through preventive measures.

- Blockchain:

- Fraud Detection: Blockchain technology enhances transparency and traceability in transactions, reducing the risk of fraud and ensuring data integrity.

- Smart Contracts: Blockchain enables the creation of smart contracts that automate policy execution and claims processing based on predefined conditions.

- Chatbots and Virtual Assistants:

- Customer Service: AI-powered chatbots provide 24/7 customer support, answering queries, processing claims, and assisting with policy management, improving customer experiences and reducing operational costs.

Benefits and Challenges

- Benefits:

- Enhanced Customer Experience: Digital technologies enable insurers to offer seamless, personalized services that meet evolving customer expectations.

- Operational Efficiency: Automation and data analytics streamline processes, reduce costs, and improve resource allocation.

- Innovative Product Offerings: Insurers can develop new products and pricing models tailored to customer needs, driving growth and differentiation.

- Challenges:

- Data Privacy and Security: The collection and use of sensitive customer data raise privacy concerns, necessitating robust data protection measures.

- Legacy System Integration: Many insurers face challenges in integrating new technologies with existing legacy systems, requiring careful planning and investment.

- Regulatory Compliance: Insurers must navigate complex regulatory environments, ensuring compliance while adopting innovative technologies.

Strong Use Cases

- Personalized Insurance Products:

- Insurers like Lemonade use AI and data analytics to offer personalized policies and dynamic pricing models based on individual risk profiles and preferences.

- Usage-Based Insurance:

- Companies such as Progressive leverage telematics to offer pay-as-you-drive policies, rewarding safe driving behavior with lower premiums and encouraging responsible driving.

- Efficient Claims Processing:

- Insurers like Allianz utilize AI to automate claims processing, reducing manual intervention and speeding up the payout process, enhancing customer satisfaction.

Compelling Case Studies for Digital Insurance Excellence

Ping An: AI-Driven Innovation: Ping An, a leading Chinese insurer, has embraced AI across its operations to enhance customer service and operational efficiency. The company uses AI for facial recognition, fraud detection, and automated underwriting, enabling faster and more accurate processes. By leveraging AI, Ping An has improved its customer experience, reduced costs, and strengthened its competitive position in the market.

AXA: Blockchain for Transparency: AXA has implemented a blockchain-based platform for flight delay insurance, providing customers with automated payouts based on smart contracts. This innovative approach enhances transparency and trust by ensuring that claims are processed automatically and fairly. AXA’s use of blockchain demonstrates the potential of digital technologies to revolutionize traditional insurance processes and drive insurance excellence.

Main Recommendations

- Embrace a Customer-Centric Approach:

- Prioritize understanding and anticipating customer needs through data analytics and personalized offerings. Develop strategies that enhance customer experiences and build loyalty.

- Leverage Advanced Technologies:

- Invest in AI, IoT, and blockchain to improve operational efficiency, reduce costs, and innovate product offerings. Continuously assess emerging technologies to stay ahead of the competition.

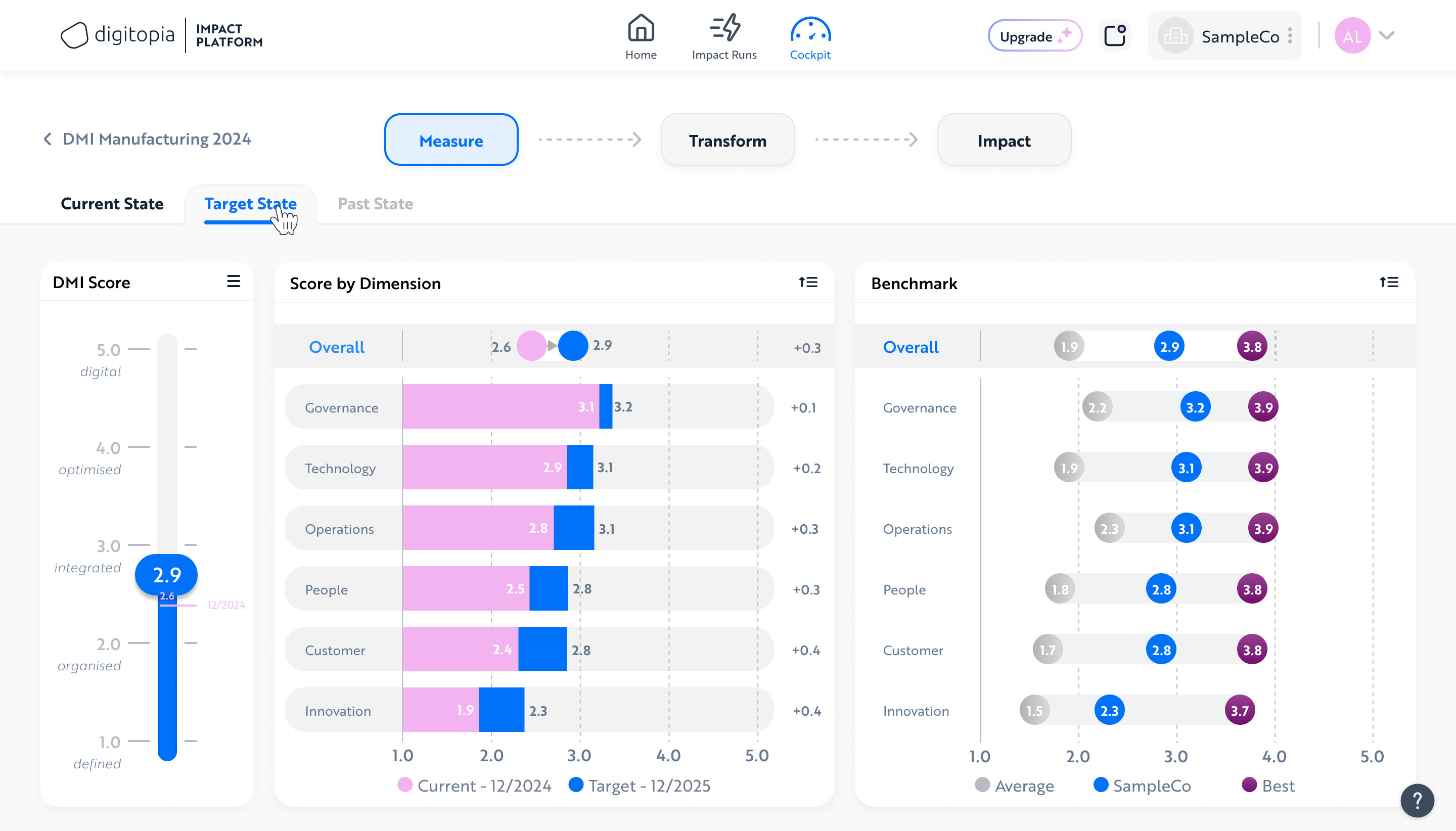

- Utilize the Digital Maturity Index (DMI):

- Conduct regular DMI assessments to evaluate digital capabilities, identify gaps, and develop strategic roadmaps for transformation. Use these assessments to guide decision-making and prioritize initiatives.

- Enhance Data Security and Compliance:

- Implement robust data protection measures and ensure compliance with regulatory requirements. Develop a comprehensive cybersecurity strategy to safeguard sensitive customer information.

- Foster a Culture of Innovation:

- Encourage a mindset of experimentation and agility within the organization. Support initiatives that drive digital transformation and empower employees to adapt to changing market dynamics.

Elevate Your Business Value in the Insurance Industry with Digitopia’s DMI Assessment

Digital Maturity Index (DMI) offers a comprehensive evaluation of your digital capabilities, tailored specifically for the retail industry. With actionable insights and benchmarking against industry peers, you can identify key growth areas, chart a clear path to digital excellence.

Conclusions

The insurance industry is at a pivotal moment in its digital transformation journey. By embracing digital technologies and focusing on customer-centric strategies, insurers can unlock significant business value and maintain a competitive edge. Executives must prioritize digital transformation initiatives and leverage tools like the Digital Maturity Index to guide their journey toward digital insurance excellence. In doing so, they can not only meet evolving customer expectations but also drive business value in the retail industry, leading to sustainable growth and profitability across both sectors.